No one likes waiting for and wondering about their tax refund. If you're hoping that money will burn a hole in your pocket sooner rather than later, the Internal Revenue Service website and app can quickly give you up-to-date information about your refund.

Here's a step-by-step guide to tracking it:

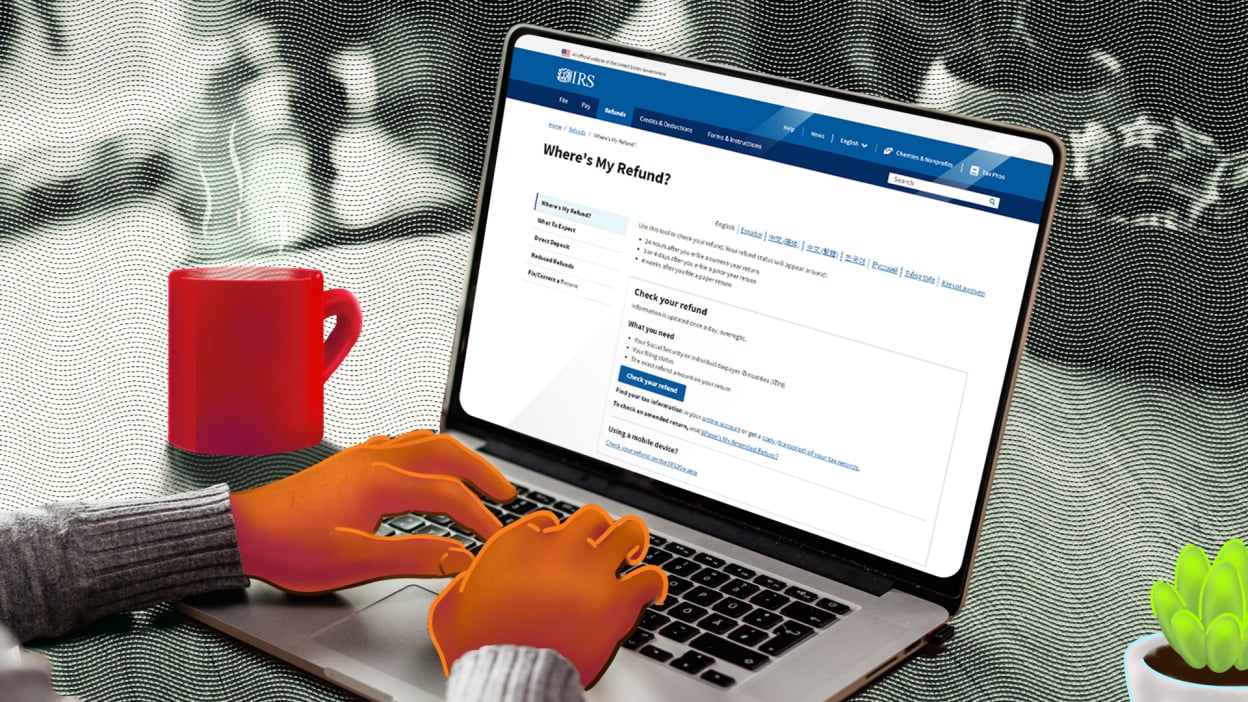

1. Visit the IRS' tracking webpage or use its mobile app.

Information about your refund will be available 24 hours after you electronically file a current-year return, three or four days after you e-file a prior-year return, and four weeks after you file a paper return.

To request information about your refund, you'll need your Social Security Number, filing status (single, head of household, etc.), and the exact refund amount on your return.

The IRS uses the information to track down your refund status.

If you prefer to check your refund's status on a desktop computer, visit the IRS' webpage Where's My Refund?.

If you want to go through the same process on your mobile phone instead of a desktop, download the IRS2Go mobile app. The refund button takes you to a prompt asking for the similar information as the webpage: tax year, Social Security number, filing status, and refund amount.

2. Determine which stage your refund is in.

Once the waiting period has passed and you've input the required information, the IRS tracking webpage and app will let you know if your return is in one of three stages: received, approved, or sent.

If a return is marked as received, that means the IRS is processing it. Once it's reached the approved stage, the IRS has cleared the refund and will issue it by the date shown. The IRS will send your refund either to your bank via direct deposit, if you've opted for it, or in the mail. It can take five days for the refund to appear in your bank account and as many as several weeks for it arrive via mail.

3. Troubleshoot any problems.

If there's a problem with your refund that requires you to contact the IRS, the refund status checker will let you know to do so. If you think your return is taking longer than usual, you can consult the IRS' processing status webpage for what to expect when filing an individual or business return. Otherwise, you just need to sit tight until the money finds its way back to you.

Topics Money Tax Season with Mashable